Sustainable Finance Round Up: January 2023

By: Bridget Realmuto LaPerla

February 10, 2023 - 2 minutes 30 seconds

Our Monthly Round Up Series delivers clients with digestible trends and take-aways on sustainable debt market movement.

Market Musings

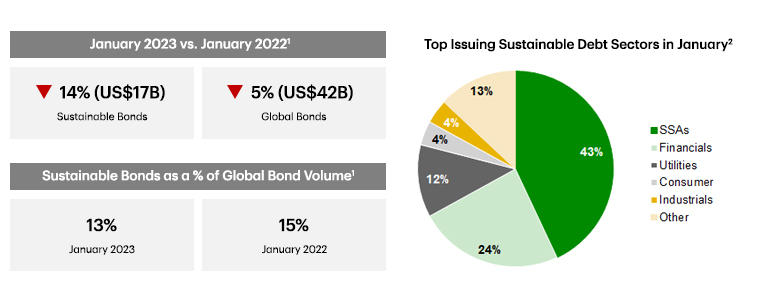

Following the quietest month on record since August 2021, January brought the return of issuers to the primary market. Despite YoY monthly sustainable bond volumes falling 14%, the EUR market posted its largest issuance week on record for the week of January 9, pricing over €27B. Consistent with prior years, SSAs have led sustainable bond issuance to kick off 2023, representing 43% of January's total volume. Inaugural green bonds helped boost supply.

SLBs: New Kids on the Block, Fitting in or Getting Bullied?

What Happened:

- A US-based advocacy organization filed a whistleblower complaint with the US Securities and Exchange Commission (SEC) against a Brazilian meat processor alleging misleading and fraudulent sustainability-linked bond (SLB) offerings issued in 2021.

- Criticism focused on the issuer's lack of credibility with the SLB's KPI selection: Scope 1 & 2 GHG emissions intensity, which represent approx. 3% of the company's overall emissions footprint.

- The complaint specifically cites the Second Party Opinion in which the reviewer states the metrics chosen were "not material to the whole corporate value chain" due to the exclusion of Scope 3 emissions, yet relevant, core and material to the company's direct operations.

Key Takeaways:

- Setting a New Precedent: This marks the first time (to our knowledge) the SEC has been asked to opine on the credibility of a sustainable debt product, potentially setting a new precedent in the market for 'naming and shaming', which is likely to pick up as we head into what is expected to be a contentious proxy season.

- SEC's Role to Play: To pursue greenwashing claims, the SEC is also working on its Climate Disclosure rules (expected April 2023) which should help draw lines in the sand around greenwashing, notably with inclusion of mandatory GHG emissions reporting. As scrutiny intensifies around the credibility of SLB structures, the SEC's ruling on climate disclosures will play a key role in shaping best practices in the SLB market going forward.

- SLB Scrutiny Will Benefit Credible Issuers: With these ongoing developments, we expect a cooling of the market to occur for new borrowers to take more time in preparing defensible SLB offerings – in turn, issuers with credible, science-based, defensible frameworks should come out as leaders. In the absence of a transition bond market today, SLBs will continue to play a unique role in allowing issuers to highlight their transition efforts.

- Source: Bloomberg; Corporate/Government bond new issuance volume (excluding loans) as of 2/1/2023.

- Source: Bloomberg; Corporate/Government new issuance volume across sustainable debt products (including loans) as of 2/1/2023.

TD Securities' ESG Solutions

TD Securities' ESG Solutions team is the centralized ESG expert resource, delivering financing advisory services, thematic and investor insights, and carbon markets solutions to help our clients reach their goals.

Director, ESG Solutions

Director, ESG Solutions

Director, ESG Solutions